When companies use GAAP as their guide, they know that everyone else will use the same rules. How do you know the right way if you're a business owner and want to measure your company's performance? That's where GAAP comes in.Īs we mentioned, GAAP is an accepted set of rules that companies must follow when they report their financial statements and make budget decisions. One of the biggest problems with accounting is the many ways to do it. Here are eight reasons why GAAP is important: 1) They Provide An Objective Standard For Measuring Profit Things like whether you're profitable or not, how much money you're making, and how much you're spending. They also help you to understand your company's financial health.

Gaap cost principle how to#

Why? For starters, they help you to know what your numbers look like and how to make sense of them. Why Are Generally Accepted Accounting Principles (GAAP) Important? So, the goal is to represent a company's financial condition at any moment accurately.

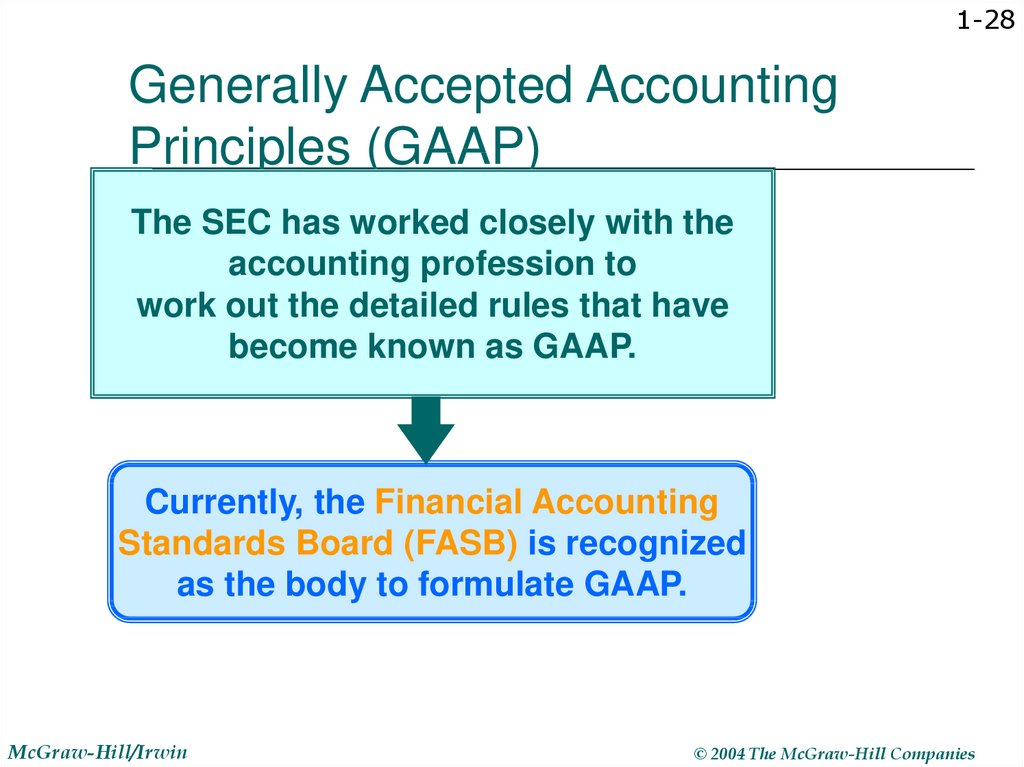

The primary purpose of GAAP is to provide an unbiased standard for recording, reporting, and interpreting financial transactions. Companies must follow GAAP because they want their stock prices to be as high as possible to raise investors' money. GAAP is important because it helps investors compare financial information from different companies and make informed decisions about which stocks are better investments. The goal of GAAP is to provide a standardized system for accounting that ensures consistency across all companies, regardless of size or industry. GAAP is used to manage business operations and ensure everyone is on the same page regarding money matters. Securities and Exchange Commission (SEC). These standards are created by the Financial Accounting Standards Board (FASB), which is part of the U.S. They're also the rules that regulatory agencies use to ensure that companies report accurate information. Companies use these guidelines to keep track of their finances and prepare financial statements.

GAAP stands for Generally Accepted Accounting Principles. This information can only be useful for internal purposes, such as planning future projects or deciding how much to charge for your product or service. Cost accounting provides information about the costs of producing goods or services rather than an accurate picture of what is being spent to create them. General accounting principles (GAAP) are the ones that are used to establish the standards for financial reporting in the United States.Ĭost accounting differs from GAAP because it is more flexible concerning defining costs and what costs should be included when analyzing financial statements. GAAP does not accept cost accounting and may only be utilized internally. This allows them to plan for unexpected expenses such as maintenance costs or employee benefits, which can cost more than expected if not anticipated correctly! Is Cost Accounting GAAP? It also helps you identify which processes are more expensive than others and adjust accordingly.Ĭost accounting makes it easier for companies to budget for expenses and predict future payments based on past data. It allows you to ensure that your products are priced competitively and attract willing customers. You can make better business decisions by identifying the costs of producing a product or providing a service.Ĭost accounting helps you understand how much it costs to produce something so that you can set prices based on the actual costs. What Is The Purpose Of Cost Accounting?Ĭost accounting aims to track and analyze costs in a business. The main goal of cost accounting is to assign monetary values to the various resources used in a product's production, distribution, selling, and servicing.Ĭompanies can use this information to determine whether they're making money on a particular product or service and, if not, what they need to do to improve their margins.Ĭost accounting also helps management decide things like outsourcing production or setting prices based on total costs instead of just variable costs (like raw materials). It helps companies determine how much it costs to make their products to decide how much they should charge customers. Why Are Generally Accepted Accounting Principles (GAAP) Important?Ĭost accounting is calculating and recording the costs of producing a product or service. It tells you what to do and how to do it. GAAP is like a rulebook for accounting and reporting. But what does that mean, and why is it important? GAAP stands for Generally Accepted Accounting Principles, which accountants must follow to ensure the accuracy of their financial statements.

0 kommentar(er)

0 kommentar(er)